bookkeeping.today

Easy VAT Returns with Making Tax Digital.

Bookkeeping Today is a simple cash-book for small businesses. You can record your sales, purchases and other transactions.

If you are VAT registered you can produce your full VAT Return, with full support for:

- Making Tax Digital for VAT (MTD)

- Standard and Flat Rate VAT schemes

- Reverse Charge VAT

- Postponed VAT Accounting (PVA) for importers

- EC Sales figures for exporters

Making Tax Digital for VAT

VAT registered companies in the U.K. can take full advantage of HMRC's Making Tax Digital for VAT system. You can submit your VAT Returns, view previously submitted returns, and check your history of VAT liabilities and payments.

Simple Bookkeeping Software On Any Device.

Most small businesses find accounting complicated and time-consuming. Your accountant will prepare your yearly accounts anyway, so a lot of that time is just wasted.

Bookkeeping software is much simpler (especially the way we do it), and takes much less of your time. With Bookkeeping Today you can keep clear records, giving your accountant less work to do, and save on accountancy fees.

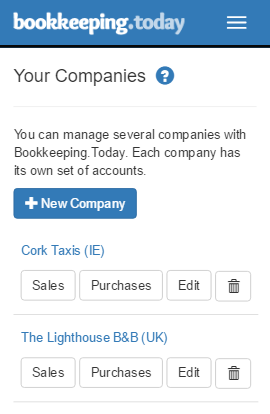

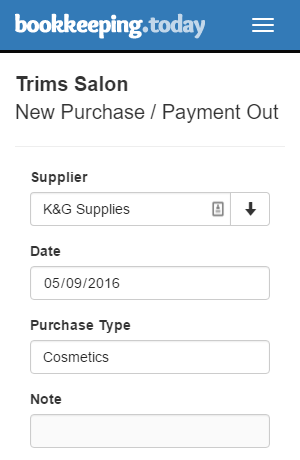

Use a PC, Tablet, Phone, or Macintosh. You are free to do your bookkeeping anywhere and on any device. You can start on an iPad, and finish off on a laptop - it's up to you!

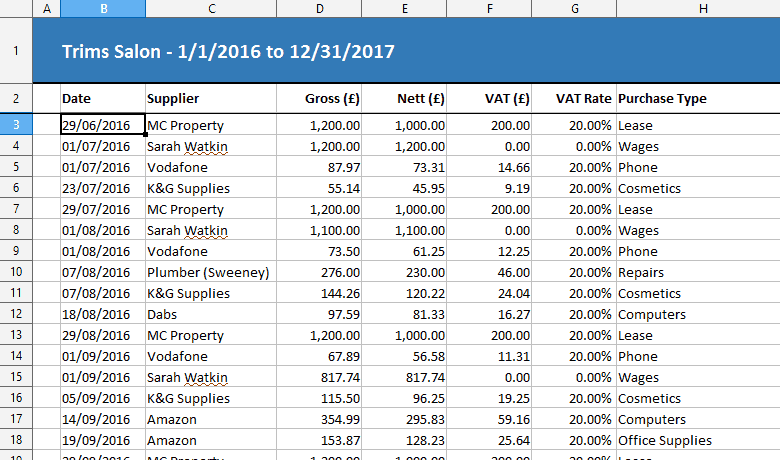

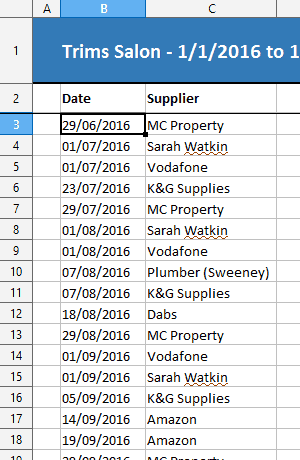

Spreadsheets For Your Accountant When They Need Them.

When it's time for your accountant to do your accounts or taxes (or whenever you need), you can easily save your data as a spreadsheet file. Bookkeeping Today produces MS Excel files, a standard format that all accountants use.

Take A Closer Look

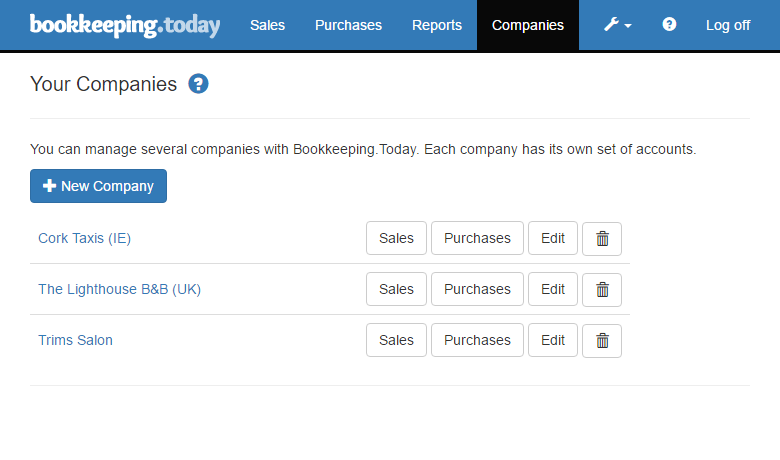

Multiple Companies

Bookkeeping Today was built to be multi-company. You can run several companies with a single login, each with it's own set of accounts.

Are you bookkeeping for 2, 5 or 100 businesses? Bookkeeping Today will make that easy for you.

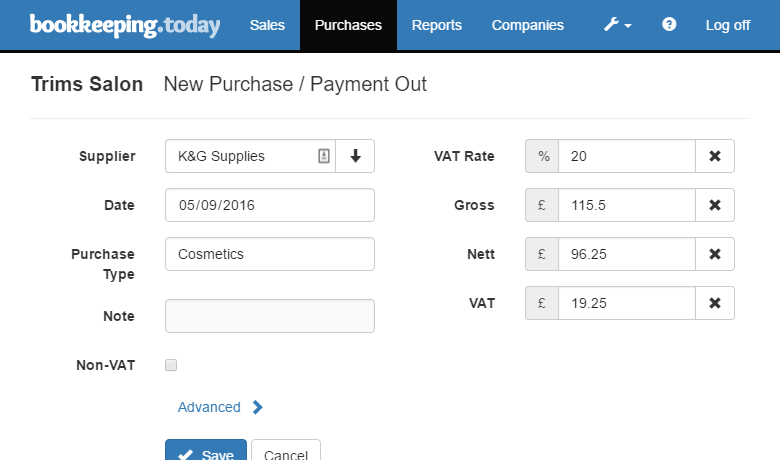

Smart And Easy To use

Entering sales and purchases is quick and simple with smart helpers to help you along. Our smart VAT calculator means you only have to enter the Gross or Nett price, it will calculate the rest, and smart lookups will pre-fill details of existing customer and suppliers to save you time.

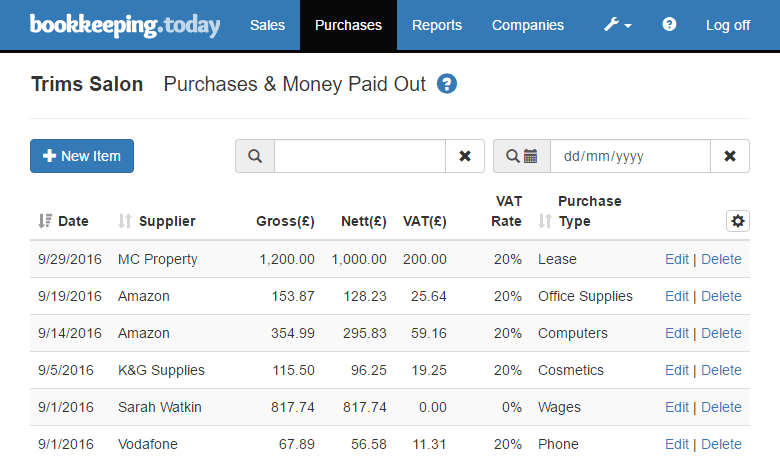

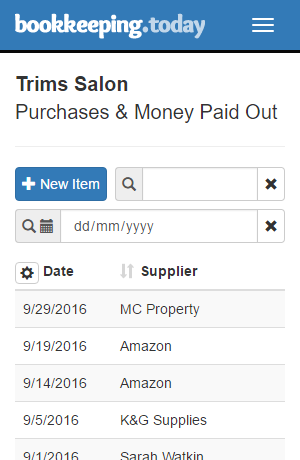

List and Search

Search your transactions for text or by date, so the details are always easy to find.

The sales and purchases lists can be customised to show just the details you want, and are easy to use on mobile devices and phones!

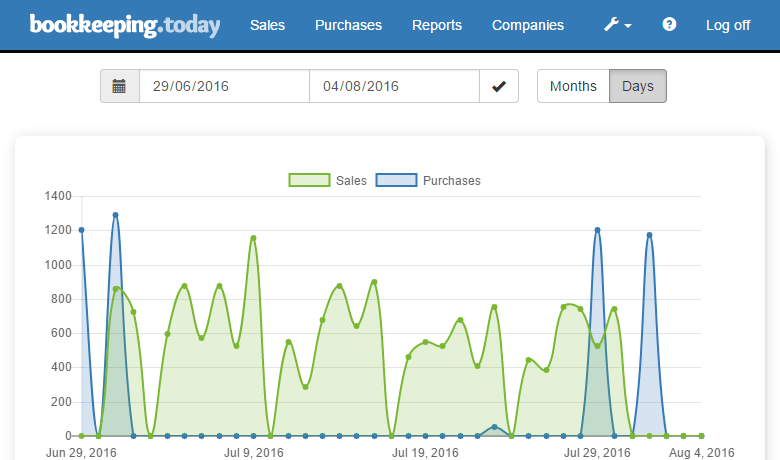

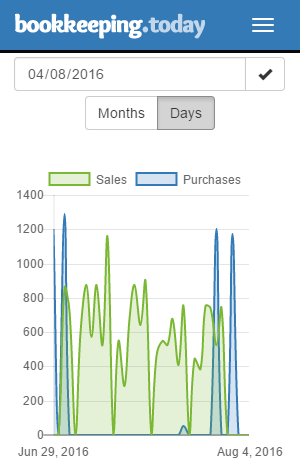

Financial Charts

Bookkeeping Today's charts are a great way to get an overview of your business, letting you see how income and expenses happen over time.

They are also a great way to see totals and other information. For example, if you want to see your total sales for a day or month, the sales chart has that for you!

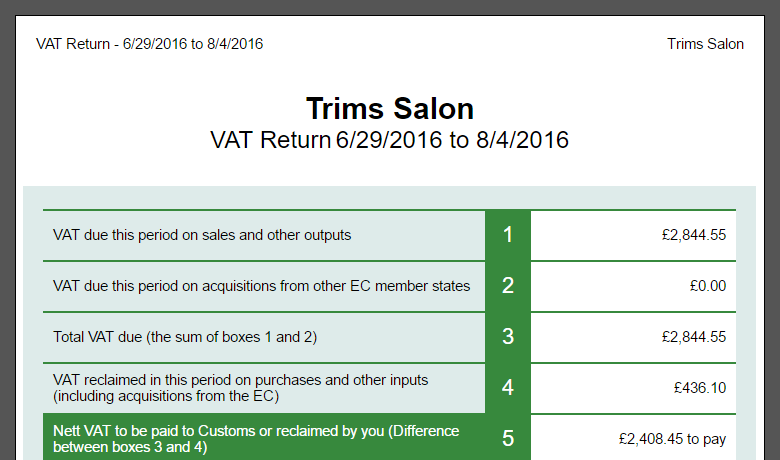

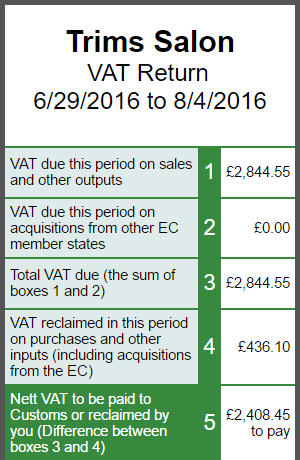

Reports and VAT Returns

Bookkeeping Today's reports are fast and easy to understand, and can be viewed as a web page or as a PDF file for easy printing.

Bookkeeping Today has full VAT reporting, including VAT Returns. And, if you are an exporter it has your EC Sales List.

Save Spreadsheets

You can quickly save all or part of your data as a spreadsheet. Ideal for sending to your accountant for your end of year taxes.

Bookkeeping Today creates MS Excel files, which are compatible with MS Office, LibreOffice, and OpenOffice, and can be used on PC, Mac, Android and Apple devices.

Latest News

Bookkeeping Today now supports HMRC's Making Tax Digital for VAT system, and the Postponed VAT Reporting Scheme! (for UK importers)

Update History

| Version | Changes |

|---|---|

| v1.4.9 | Improved - The Sales and Purchase Summary Reports now include details by month when the report spans multiple months. |

| v1.4.8 | New - Added a VAT Return Details Report showing a breakdown of your VAT Return and the transactions included in each box. |

| v1.4.7 | Improved - Better totalling for sales and purchase reports. |

| v1.4.6 | Improved - Clearer wording for VAT Returns when using the Flat Rate Scheme. |

| v1.4.5 | Fix - HMRC MTD VAT Statement handles unusual cases better. |

| v1.4.4 | New - Added help on reverse charge, and VAT payments and refunds. |

| v1.4.4 | Impoved - Increased the maximum value of financial fields to 1 Billion to help in countries with weaker currencies. |

| v1.4.3 | Impoved - Making Tax Digital signup process with HMRC greatly simplified. |

| v1.4.2 | Impoved - better handling of mistyped dates. |

Show More / Less